The localization rate of automotive aluminum plates in India is less than 30%: a golden opportunity for Chinese suppliers

1. Current imbalance between supply and demand

Capacity gap: India’s current annual demand for automotive aluminum plates reaches 420,000 tons, while its local production capacity is only 120,000 tons, with a reliance on imports exceeding 70%;

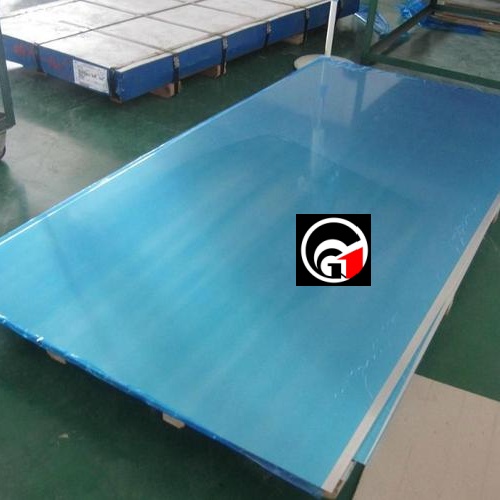

Technical bottleneck: Local companies such as Vedanta Aluminum still focus on primary products, and 90% of high-end automotive plates (6xxx/7xxx series) need to be imported from China, Japan and South Korea;

Policy catalysis: The Indian government has included automotive aluminum plates in the PLI (production-linked incentive) program, with a subsidy of 1,800 rupees per ton for localized procurement (effective in 2026).

2. Market growth drivers

New energy vehicle explosion: Tata, Mahindra and other automakers plan to increase the proportion of electric vehicles to 25% in 2027, and the demand for aluminum battery shells/anti-collision beams will increase by 45% annually;

Lightweight mandatory standards: BS-VI emission regulations have promoted the aluminumization rate of commercial vehicles from 8% to 18%;

Cost advantage: The comprehensive cost (including tariffs) of Chinese aluminum plates exported to India is still 22% lower than that in Europe.

3. Localization breakthrough path

Technical cooperation: Joint venture with Hindustan Aluminum and others to transfer cold rolling/heat treatment core technology;

Supply chain pre-positioning: Set up a shearing processing center in Gujarat to achieve 72-hour delivery response;

Certification acceleration: To pass the Indian ARAI certification, it is necessary to prepare the BIS test report 6 months in advance.

Strategic advice: Prioritize the development of 2.5-4mm thick aluminum plates for automotive structural parts (T4/T6 status), and provide IMDS compliance data packages.